Experience Counts

Steven J. Obranovich Professional Corporation was established in 1991 to provide accounting, bookkeeping and taxation services to small and mid-size businesses. Understanding each client's issues and goals in order to ensure the delivery of the best possible solution with integrity, and exceptional service was the founding principle.

Expert Advice

The ever changing taxation and business legislation has made professional advice critical to the success of today's businesses. We provide the information and tools to make strategically sound business decisions to help maximize profits, while minimizing taxes.

Remove the Hassle

CRA sets out strict due dates for various filings and payments. Failure to meet these deadlines can result in interest, fees, or penalties being assessed to the taxpayer. We can help remove the administrative requirements and potential penalties by keeping you on track.

Support When Needed

We are here to support you, whether by phone or email, even on weekends and holidays whenever you need us.

Accounting Services

Payroll

Payroll is a major expense for most businesses and involves tracking hours, wages paid and source deductions. Our services include processing hourly/salary payrolls on a weekly, bi-weekly or monthly basis. In addition, we prepare the source deduction schedules for clients – monthly, semi-monthly or quarterly, and Records of Employment when required.

HST Monthly & Quarterly

Registrants are required to file HST Returns on a monthly, quarterly or annual basis. Annual filers are required to make quarterly installments. We can help keep you on track with the filing and installment deadlines.

Financial Statements

Our compilation services help to assist management in the presentation of their financial information in financial statement format and in the preparation of Income Tax returns. Review Engagements provide assurance regarding the financial information in accordance with Accounting Standards for Private Enterprises (ASPE) or Accounting Standards Non-Profit Organizations (ASPO).

Personal Income Tax

Taxation is becoming more complex each year. We have over 40 years of experience in personal income tax preparation, including proprietor businesses, rental properties, and employment expenses.

Government Filings (T4, T3, T5's)

Employers are required to file T4’s on an annual basis with CRA. We can help balance your source deduction remittances and file the T4’s prior to the February 28th deadline. Information is obtained from your accounting system or from our system if we prepare your bookkeeping.

Bookkeeping

Bookkeeping involves the recording of a company’s financial transactions on a regular basis. Up-to-date bookkeeping allows companies to track and analyze all financial information in order to make key operating, investing and financial decisions.

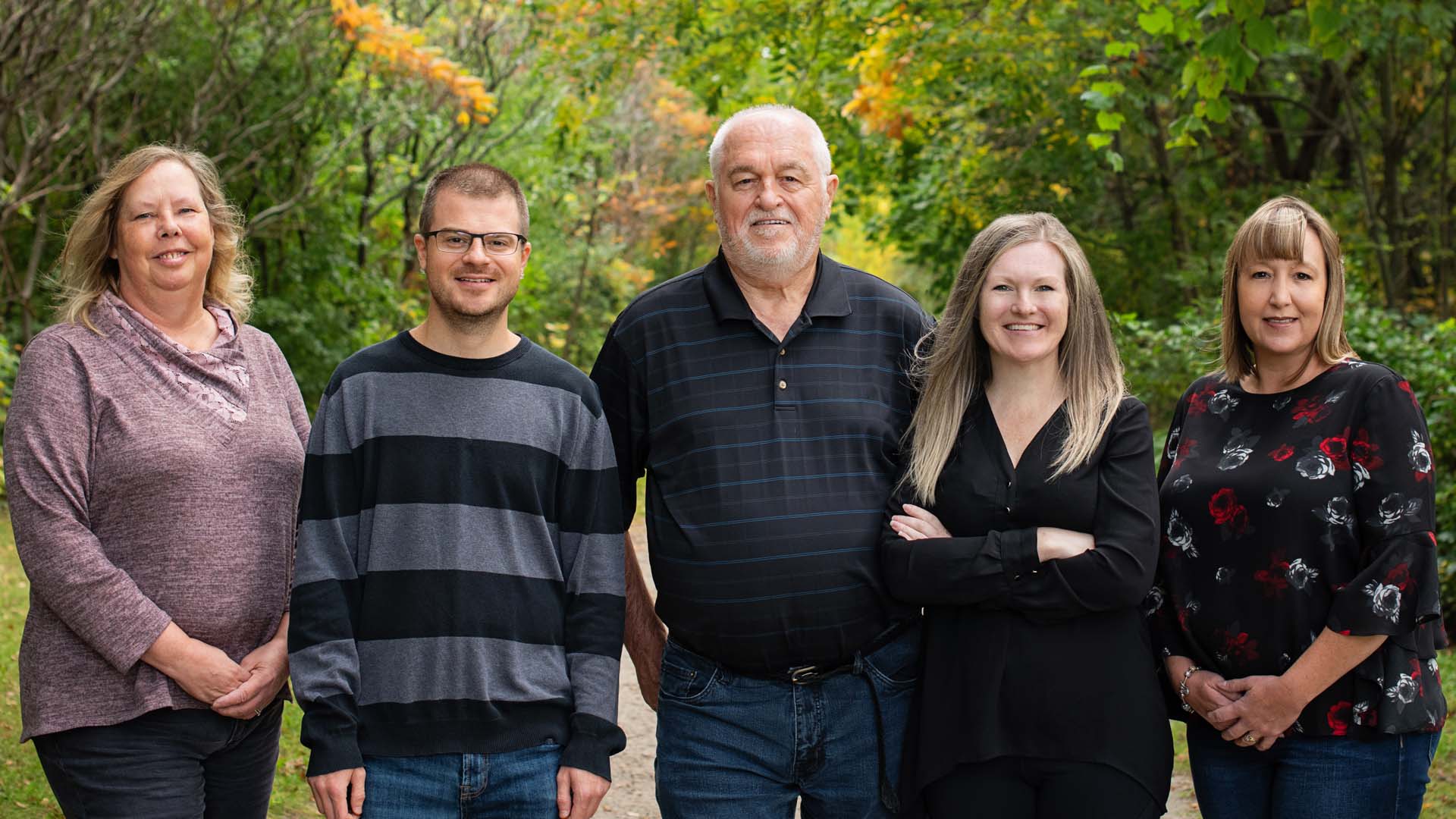

The Team

Steven J. Obranovich Professional Corporation is an experienced, dynamic and energetic team of professionals who will provide timely, efficient and accurate support for all your business needs.

Steven J. Obranovich

Steve began his accounting career in 1976 working for a downtown Toronto firm of Chartered Accountants. After two years of auditing, he moved into the food retail and manufacturing industry where he gained 18 years of experience and held positions of Controller, V.P. Finance & Administration, and President & CEO.

Read More

Melissa Diamond

Melissa has worked in the insurance and public accounting sectors and has more than 15 years of accounting experience. She joined The Steven J. Obranovich Professional Corporation in October 2009 and currently holds the position of Staff Accountant. She manages the firm's small business clients through bookkeeping and compilation engagements as well as personal and corporate tax returns.

Read More

Richard Obranovich

Richard is a graduate of George Brown College in Toronto and joined Steven J. Obranovich Professional Corporation in 2010 as a bookkeeper/tax preparer. He has over 6 years of experience and is responsible for the preparation of accurate and timely financial information and payrolls for various clients, in addition to the preparation of personal and business income tax returns.

Read More

Karen Knightly

Karen has over 15 years experience in customer service and is a graduate of Sheridan College. She joined Steven J. Obranovich Professional Corporation in January 2018 and has over 3 years of bookkeeping and personal income tax preparation experience.

Read More

Kathy Millar

Kathy has over 37 years of experience working for a firm of Chartered Professional Accountants prior to joining Steven J. Obranovich Professional Corporation. She manages a group of clients providing bookkeeping, monthly and quarterly CRA reporting, CRA audit support, and income tax preparation services.

Read MoreContact Us 7 Days a Week

We are here to support you, whether by phone or email, even on weekends and holidays whenever you need us.